Reimagined experience

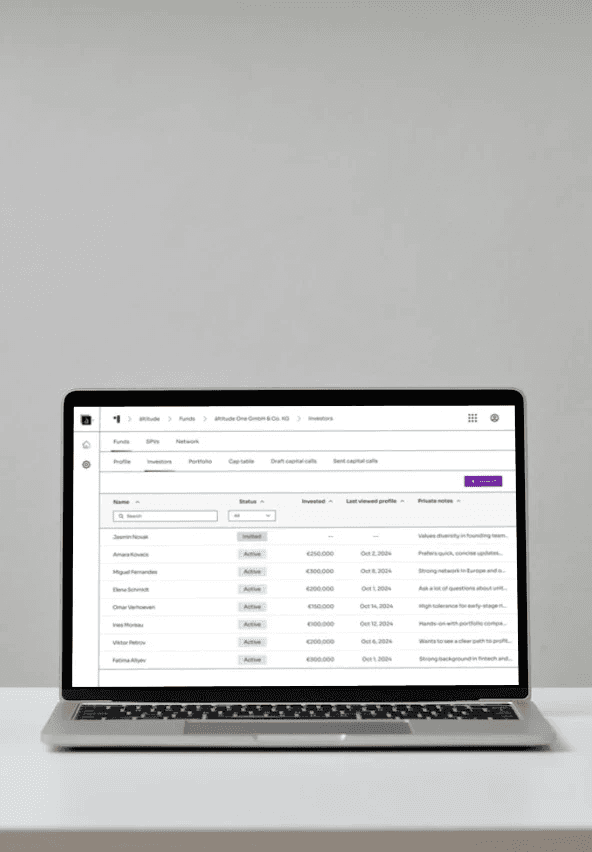

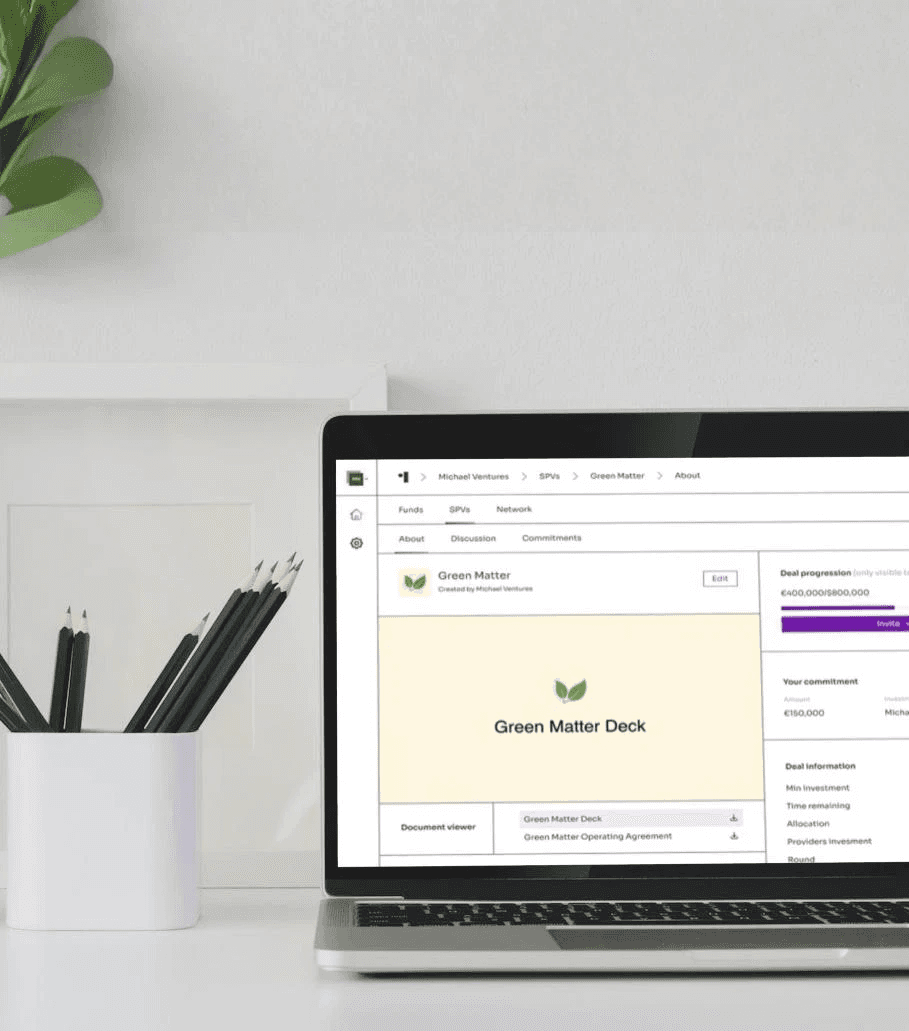

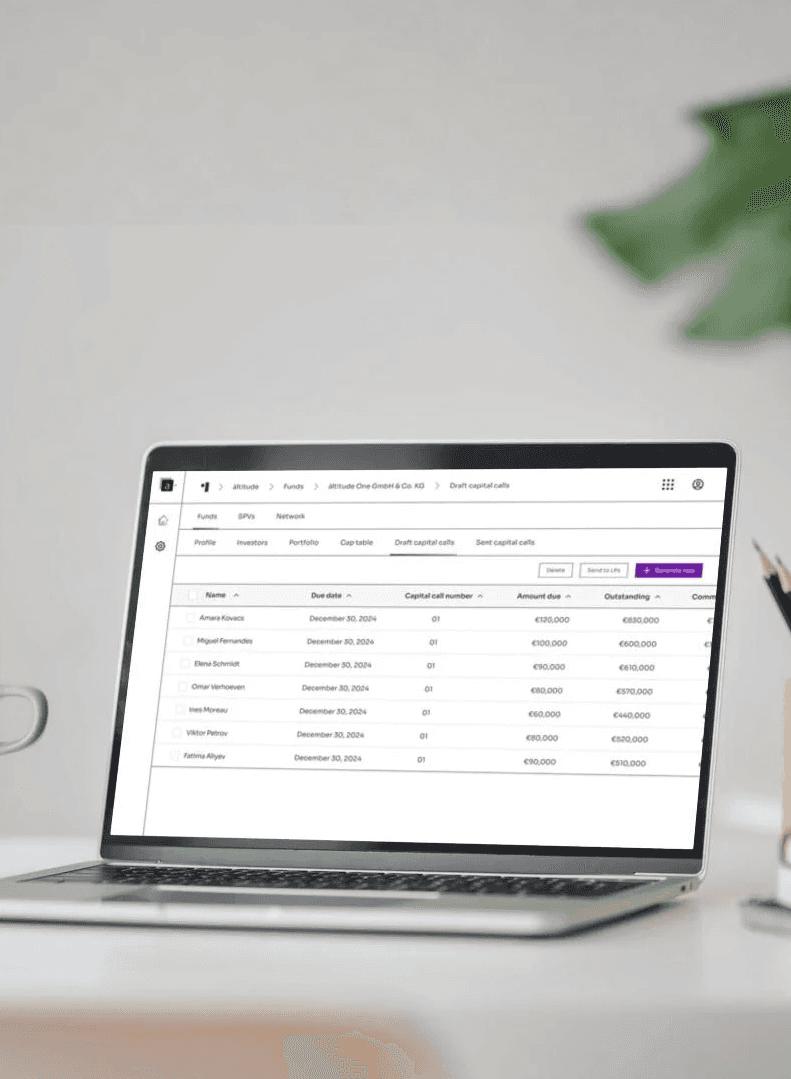

Effortless fund management with end-to-end support, from setup to close. Add new funds, invite LPs, create SPVs, and track performance—all in one platform. The suite of Allocator One's tools are designed to save you time and help you focus on growing your investments, not on completing administrative tasks.

Launch your fund

Ready for setup?

From fund setup to tracking performance, our platform simplifies every step, helping you stay organized and focused on growth.

Expert support

Let our team of experts handle quarterly reporting, AML/KYC compliance checks, and end-of-year readiness.

Outperform

Give your LPs a simple online onboarding and closing process through a centralised platform.